ROM InWest invests from an early stage in innovative entrepreneurs who accelerate transitions and strengthen the future earning capacity of the region-just when the market is still hesitant. We invest through three funds: the SME Fund, the Transition Fund and, since 2024, also the PDENH Fund.

Invests in innovative startups, scale-ups and projects that drive the energy transition and circular economy and accelerate.

Invests in growing SMEs that use digitisation and innovation to strengthen the North Holland economy.

This closed-end fund of the province has been investing in companies promoting energy transition, circular economy and sustainable mobility since 2014.

ROM InWest invests from an early stage in innovative entrepreneurs who accelerate transitions and strengthen the future earning capacity of the region-just when the market is still hesitant. We invest through three funds: the SME Fund, the Transition Fund and, since 2024, also the PDENH Fund.

Three funds, three managers and three key questions. An interview with Vincent Vierhout (MKB Fonds) , Isabel van Nesselrooij (Transitiefonds) and Leendert van Waart (PDENH) on the ins and outs of an investment fund.

ROM InWest invests from an early stage in innovative entrepreneurs who accelerate transitions and strengthen the future earning capacity of the region-just when the market is still hesitant. We invest through three funds: the SME Fund, the Transition Fund and, since 2024, also the PDENH Fund.

Invests in innovative startups, scale-ups and projects that drive the energy transition and circular economy and accelerate.

Invests in growing SMEs that use digitisation and innovation to strengthen the North Holland economy.

This closed-end fund of the province has been investing in companies promoting energy transition, circular economy and sustainable mobility since 2014.

ROM InWest invests with revolving funds where the market fails or change is too slow. Once investments generate returns, the money flows back into the fund for new financing initiatives.

ROM InWest invests public funds in innovative entrepreneurs working on solutions with high societal impact. These are often complex and risky innovations that take time-that is why the market is not yet jumping in. We do.

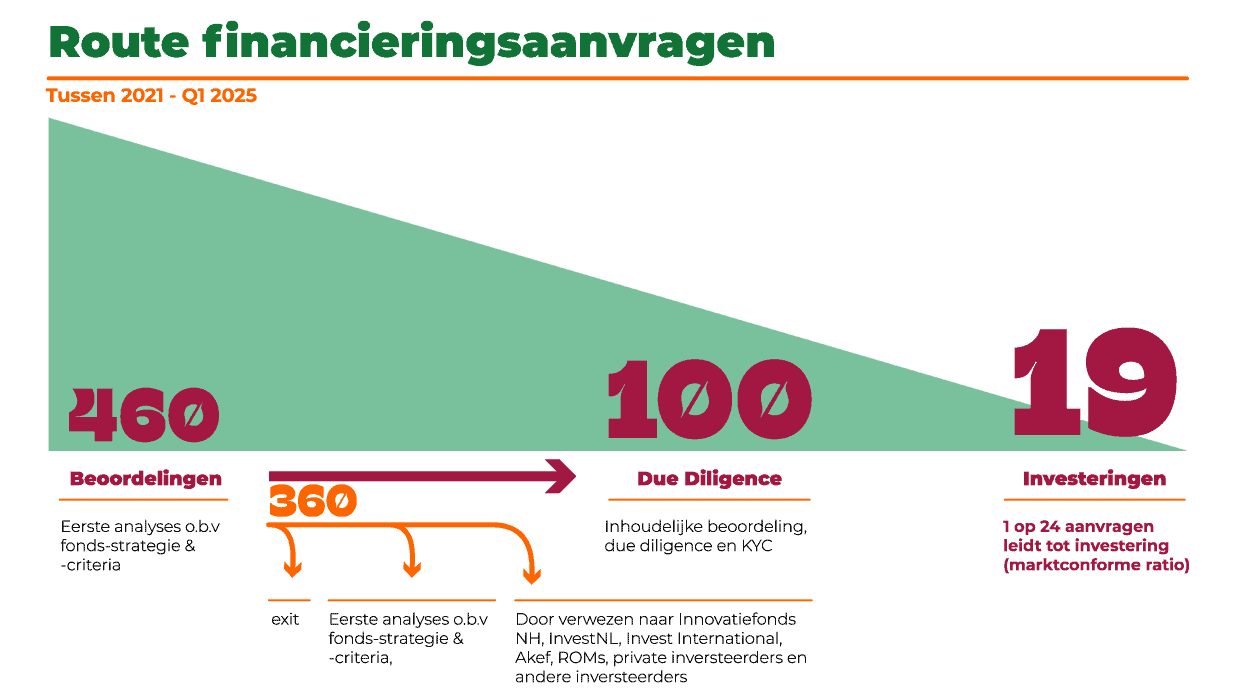

As public money is involved, we conduct a careful decision-making process, while ensuring that the turnaround time of an application remains within reasonable, market-oriented deadlines.

After receiving the application, we assess whether it fits within the scope and conditions of the fund.

The project plan and budget are shared with us. In-depth discussions take place and the entrepreneur presents the plan to the investment team.

In case of a positive assessment, the investment team prepares a proposal for the independent Investment Committee. It advises the board, which takes the final decision.

In case of a positive decision, external due diligence follows: legal review, KYC investigation and third-party technical validation.

In case of a positive outcome, we draw up a financing agreement together with the entrepreneur and other financiers, including the chosen form of financing (loan or participation).

After agreeing on the agreement, the board takes the final decision and funding is provided.

ROM InWest invests from an early stage in innovative entrepreneurs who accelerate transitions and strengthen the future earning capacity of the region-just when the market is still hesitant. We invest through three funds: the SME Fund, the Transition Fund and, since 2024, also the PDENH Fund.

Invests in innovative startups, scale-ups and projects that drive the energy transition and circular economy and accelerate.

Invests in growing SMEs that use digitisation and innovation to strengthen the North Holland economy.

This closed-end fund of the province has been investing in companies promoting energy transition, circular economy and sustainable mobility since 2014.